From a sales standpoint, those late-night infomercials hawking gadgets with the promise of “four easy payments of just $19.95” were truly visionary. Love them or hate them, the allure of BNPL or Buy Now, Pay Later, has a psychological effect on buyers.

And it’s easy to see why. Breaking down the price-averse barriers of “I’m not paying $79 for a glorified toaster” and transforming it into ‘less than $20/month to make my own panini every day? Sold!” has the dual-pronged effect of instant gratification. The consumer gets their product now as opposed to having to wait, and in their mind, they’ve already rationalized the purchase as “$20 a month is pocket change!”

So it comes as no surprise that using Buy Now, Pay Later in your online advertisements and marketing campaigns has an equally attractive benefit.

Easy Transactions and Flexible Payments

No matter what you’re selling, your customers want an e-commerce process that’s easy to complete and offers them flexibility with their payments. Major BNPL services Affirm and Klarna have each done independent studies that show online BNPL solutions generated an 85% lift in average order value along with a 20% increase in repeat purchase rate.

Klarna even did a second study that found that adding a “Pay Later” option to the checkout process resulted in 7% higher conversion rates than with traditional credit card transactions.

In addition to making the transaction process easier and more financially attainable, this flexibility also helps increase customer loyalty. By giving customers the option to spread out their payments over a set period of time, you create a notion of trust and credibility, which go hand in hand with a great overall customer experience – a winning combination in the ultra-competitive e-commerce world.

Buy Now, Pay Later Post Pandemic

Beyond its measurable effect on conversion rates, the resurgence of BNPL has also helped to stimulate economies in a post-pandemic world. No one can deny the effect that COVID-19 had and continues to have on countries around the world, causing many consumers who are concerned about cash flow to be able to more effectively manage their spending.

For example, Klarna allows its users to pay in four interest-free installments or in 30 days. To achieve this, it does a “soft” credit check which does not affect the user’s credit score. This allows users to leverage the flexibility and peace of mind that comes with BNPL right away versus the uncertainty they may feel with having to pay in full at checkout.

A Win for Consumers and Sellers

BNPL has made its mark in the world of e-commerce and is showing no signs of slowing down. In fact, these types of services are expected to grow at nearly 40% per year. It’s estimated that by 2023, nearly 3% of all global e-commerce revenues will be directly attributed to BNPL functionality.

When you bundle up the convenience of deferred payments and instant credit together with the increase in brand loyalty and conversion rates, it’s easy to see how BNPL can be a major win for both consumers and sellers.

Adding BNPL Options to Your Product Feeds

Now that you better understand the benefits that BNPL can have on your conversion rates, how do you get started with it? The good news is that you don’t need to go back and retroactively resubmit your entire product feed with all new images highlighting your BNPL options.

With Waterbucket, your Facebook dynamic product ads are automatically updated to reflect the latest products and prices all according to the template you choose.

This allows you to offer unprecedented flexibility to your customers by putting the products they love within their financial reach, while positioning yourself as a retailer who fully embraces the customer experience.

By using Waterbucket, you get the benefit of feeds that automatically update while enjoying seamless integration with the most recognized BNPL providers, including Affirm, Klarna, Sezzle, Afterpay and more.

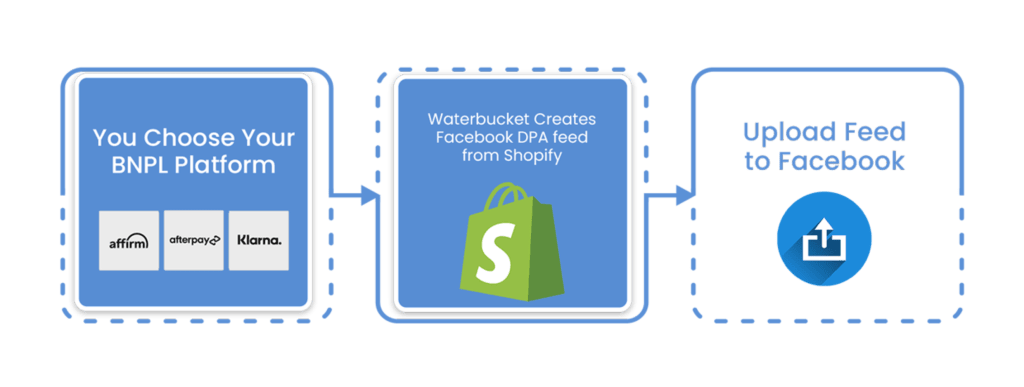

Plus, you can get started in just three simple steps:

- Choose your BNPL provider (Affirm, Afterpay, Klarna, etc.)

- Let Waterbucket create your Facebook DPA feed from Shopify

- Upload your feed to Facebook

Getting Started with BNPL for Conversion Optimization

The best part is that there’s never been a better time to start enjoying the across-the-board benefits that BNPL offers. Increased conversion rates are only the beginning. The goodwill, brand loyalty and ease of use delivered as a result are things you can’t quantify or put a price tag on, making now the time to act to take advantage of this fast-growing conversion rate optimization strategy.

We invite you to try Waterbucket for yourself risk-free for 7 days! If your conversion rate doesn’t increase by at least 20% as a result of using the Waterbucket platform, we’ll extend your free trial until it does! That’s our promise and our guarantee to you.

How are we able to make such a compelling offer? Because we know that once you see how easy it can be to instantly and automatically add the benefits of BNPL to your product feed, your Facebook dynamic product ads will perform better than they ever have.

And it’s easy to get started. Simply click here to start your free trial and then let our system guide you step-by-step through the process. Then sit back, relax and let our intelligent machine learning algorithm do all the heavy lifting while you benefit from increased conversion rates and improved customer retention. We can’t wait to see what Waterbucket can do for you!